O único atacado da Malásia, a Rede de 5G Gambit desenha questões críticas

“But it seems that Malaysia is the only country looking to do this for mainstream [nationwide] 5G.”

Why SWN?

According to industry insiders DNA spoke to, it isn’t clear why the government and MCMC decided to use an unproven, SWN model to roll out 5G in Malaysia.

Before the Malaysian government fell in March 2020, the previous administration favoured a ‘single consortium model,’ where the 700MHz and 3.5GHz frequency bands were to be allocated via “a single entity comprising a consortium formed by multiple licensees, instead of individual licensees.”

The model required undertaking an open tender process to select a consortium comprising a few qualified telcos and related companies, which will build common 5G infrastructure that will be shared by all players.

This was done to lower capital expenditure (capex) by minimising costs and preventing the duplication of infrastructure, at a time where improvements in 4G networks are continuing, the MCMC had then argued.

READ MORE: Malaysia's 5G spectrum conundrum: A blessing in disguise?

“The move towards a SWN took us by surprise completely,” one senior industry executive familiar with telco spectrum assignments told DNA on condition of anonymity due to the sensitive nature of the topic.

The executive said just as the industry was adjusting to the possibility of a consortium idea over the traditional ‘beauty contest’ model, it was hit by the deployment of a SWN model.

“This [SWN] isn’t a proven model and has caused significant delays and losses for those who have tried it.

“Government-owned networks are rare, and in the world today, one can perhaps argue that Australia’s National Broadband Network (NBN) is the only project that is justifiable. But that is primarily a fixed-fibre project that involves extremely high capex.

“But mobile broadband has always benefited from healthy competition and we have moved away from monopolies for decades now. This to me is backward thinking.”

Still, MCMC’s Fadhlullah was adamant the arrival of the Covid-19 pandemic has forced the government’s hand to make Internet connectivity a priority in Malaysia, especially in rural areas where people are struggling to get on board.

Exacerbating these challenges is the high investment needed for 5G network roll-outs, which he claimed without citing sources, could cost between up to 75% more than what was needed for 4G.

The MCMC chairman argues that because DNB will own all 5G assets, there will be minimal duplication of network elements, reduction in the inefficiencies in spectrum allocation, and infrastructure and land approval challenges can be effectively addressed.

Razões possíveis

IDC senior research manager Zaim Halil believes the Malaysian government is hoping for quicker 5G deployment with this approach and does not want to lag behind other Asean countries that are about to roll out 5G commercially.

Malaysia is seen to be lagging behind its regional counterparts such as Singapore, Thailand and even Vietnam, which has recently pushed ahead.

In response to questions from DNA, the analyst argues that accelerating Malaysia’s 5G agenda brings a few positives, especially during this time when the Covid-19 pandemic has affected the country’s economy.

By doing so, Zaim (pic) argues that Malaysia could be positioned as an attractive and advanced manufacturing hub due to its robust digital infrastructure, thereby increasing foreign direct investments (FDI) for Malaysia.

Neil Shah, research director at Counterpoint Research, told DNA that the biggest advantage of a government-owned SWN is its ability to treat the 5G infrastructure as a “basic and important utility” that can give equal access to the masses, boost the economy and bridge the digital divide more effectively.

“Looking at Malaysia’s sordid history of spectrum acquisition, network access, competitive landscape, operator’s thinner margins and higher debt levels, the government [probably] believes it can play its part in building a robust 5G infrastructure, thereby allowing operators to focus more on services.

But he warns that this could be a double-edged sword as the government building such an SWN is not its core competency.

“Also, it's unclear if the ‘access fee’ the government will charge to the telcos will be higher or lower than the overall dividend and spectrum costs telcos have been paying to the government.

“Another uncertainty is: would the government allow enterprises and newer players to license the infrastructure to build private or public networks respectively, and how much that would cost?” he asks, noting that all these questions need to be urgently answered.

“Another uncertainty is: would the government allow enterprises and newer players to license the infrastructure to build private or public networks respectively, and how much that would cost?” he asks, noting that all these questions need to be urgently answered.

ABI Research’s industry analyst Miguel Castaneda (pic) postulates that the combination of declining revenues of mobile operators of the three big operators – Maxis, Celcom Axiata, and Digi – could contribute to this reason.

"Os requisitos de alta capex para 5g parecem ser uma boa justificação para um swn que é totalmente financiado pelo governo", ele se opina, contando DNA em uma entrevista por e-mail.

Mas a conjectura de lado, o que é claro é que um modelo de custo SWN é inerentemente inerso porque o preço de atacado de acesso à rede é determinado pelo governo, em vez de forças de mercado, argumenta Castaneda.

Isso também reduz a concorrência e a inovação entre os operadores móveis em virtude do SWN, tendo o único controle das atualizações tecnológicas de uma rede de 8g de estado, como DNB, a Castaneda tensiona.

"Operadores móveis que têm controle de sua própria rede [geralmente] têm a autonomia e o impulso para fornecer serviços diferenciados e desenvolver soluções inovadoras que podem beneficiar muito o usuário final".

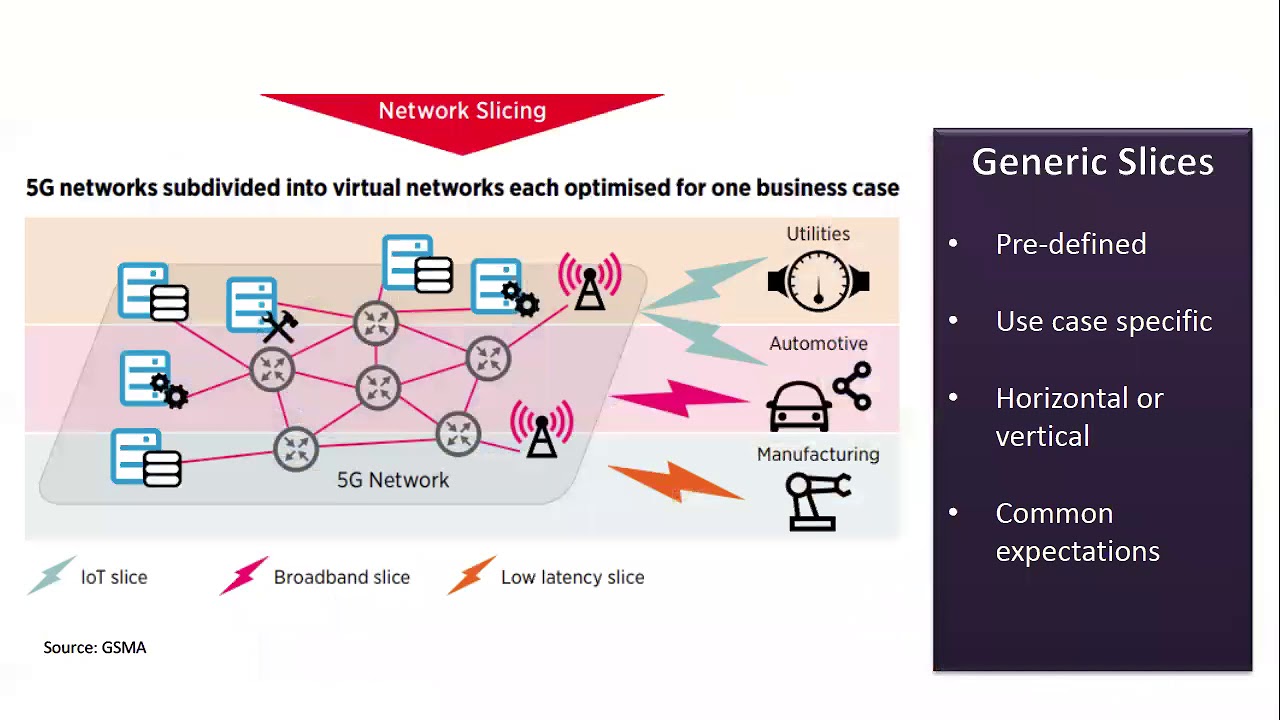

A Castaneda explica que as redes 5G estão posicionadas para atender a um mercado heterogêneo do usuário final, incluindo consumidores e empresas.

"Nossa visão é que será um desafio operacional para um swn gerenciado por uma única entidade e operando sem os incentivos de uma empresa em um mercado livre para fornecer efetivamente a conectividade de rede de qualidade em um conjunto diversificado de clientes e verticais empresariais".

Em seguida: Como o governo poderia construir sua rede SWN

Comentários

Enviar um comentário